Programmatic: Major Brands Are Spending More

Some of the world’s largest brands are spending more on programmatic advertising, just as the practice is set to become much harder.

Members of the World Federation of Advertisers (WFA) are directing 41% of their digital media budgets to programmatic channels, up from 16% in 2016. Exact figures for how much of their budgets those percentages represent were not disclosed.

Overall, programmatic is projected to account 84.5% of total display ad spend, according to eMarketer. The members of the WFA spend largely in video and on brand awareness campaigns, areas that typically haven’t lended themselves to the combination of automation and targeting.

The study from the WFA, in partnership with Iponweb, surveyed 37 global brands with a combined marketing budget of approximately $76 billion. The study didn’t name the brands involved, but the WFA counts brands like Diageo, Ikea, General Mills and Procter & Gamble as its members. The survey was conducted in Q4 2019 and Q1 2020, predating the coronavirus pandemic.

Big brands are directing more spend into a channel that’s facing serious challenges. Google is removing third-party cookies, the backbone of online targeted advertising, from Chrome in 2022. Apple will give consumers the option to opt-in to tracking when iOS 14 rolls out, meaning the ad industry will likely have less data at its fingertips.

Advertisers also have to navigate the California Consumer Privacy Act, and are staring down the barrel of likely national legislation that would put limits on how data is used for advertising purposes.

A coalition of trade bodies (including the WFA), ad agencies and brands (some of them WFA members) have recently formed the Partnership for Responsible Addressable Media to address these obstacles.

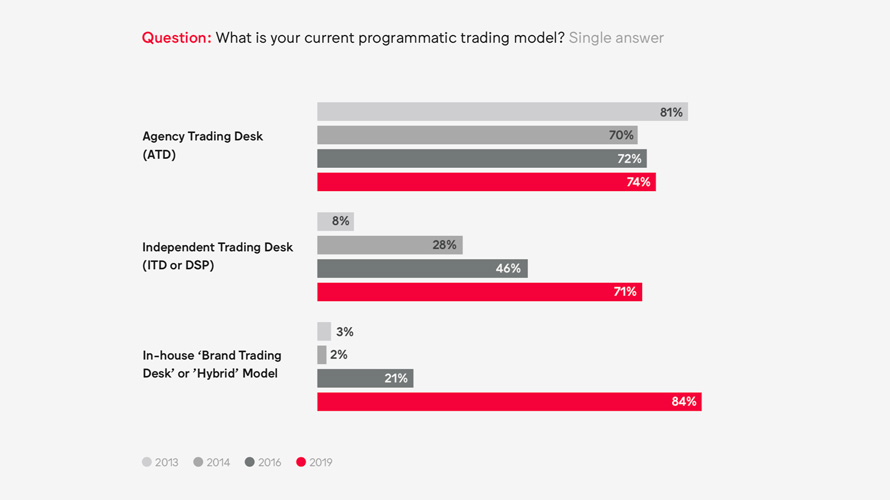

Brands aren’t going at it alone, with 74% responding that they partner with an agency either in totality or in specific markets.

Still, in-housing is on the rise, with 71% of brands saying they work directly with demand-side platforms either as a whole or in specific markets. At least 80% of brands who’ve adopted some kind of in-housing model say it has improved transparency.

Joe Meehan, gm of global solutions at Iponweb, said the programmatic ecosystem is continually recalibrating.

“In particular, there will be increasing pressure within the industry to deliver transparent supply chains, while data ownership and the relationships between the buy and sell sides will become key to activating brand data strategies,” he said in a statement. “As programmatic continues its global expansion to become the dominant distribution channel for marketing messages, these factors will play an ever-greater role in an advertiser’s ability to deliver superior results, create brand advantage and drive ROI.”

Programmatic is attractive to advertisers because they can target audiences at scale, but that becomes increasingly difficult to do in the open web as identifiers go away. Walled gardens like Google and Facebook provide an alternative, since users are constantly logged in to their closed platforms, which also makes measurement and frequency capping easier.

However, 58% of brands surveyed said visibility into walled gardens is an issue, and 42% said data sharing between platforms is a hurdle.

Ad-tech companies are in the process of building replacements to the third-party cookie that would make targeting and attribution easier across the open web, which means brands would not have to depend on platforms to reach target audiences.