Magnite Is Well Positioned To Grow Its Share Of Global Programmatic Ad Spend

Editor’s note: Seeking Alpha is proud to welcome Griffin Boss as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Introduction

The programmatic advertising supply chain is currently facing a critical overhaul that will consolidate a larger portion of global advertising spend among top platforms. Magnite (MGNI) is the largest independent pure-play omnichannel supply-side platform and stands to grow revenue at a faster rate than the industry as a result of this windfall ad spend. Combined with the attractive operating leverage of the business (high fixed costs), this will allow Magnite to expand profit margins regardless of whether or not we see further pressure on its take rate.

Lately, investor focus seems to be hyper-targeted (ad pun intended) on connected TV (CTV). While that is arguably the fastest growing area of programmatic advertising, and will certainly benefit Magnite, it is overshadowing the structural changes occurring in the industry. These structural changes are essential to understand if you are trying to get a sense of which programmatic platforms are going to come out on top over the next few years.

A Brief History

As with anything, to understand where we’re going we need to understand where we came from. In recent years advertisers and demand-side platforms (DSPs) in the programmatic industry have become increasingly critical of the large number of supply-side platforms (SSPs). In short, DSPs help advertisers buy digital advertising inventory. SSPs connect the DSPs to the publishers that provide the advertising inventory. SSPs have proliferated since header bidding hit the scene in 2014/15. However, the resulting fragmentation of the supply-side has led to increased complexity and added costs to the entire supply chain of programmatic advertising.

Don’t get me wrong, header bidding isn’t the problem – it was a fantastic innovation in the industry that evened the playing field and dramatically increased revenue for publishers. For those who are unfamiliar, before header bidding certain SSPs usually had exclusive or preferential access to specific programmatic ad inventory. This gave buyers little choice but to work with the SSPs that had access to their desired inventory and allowed those SSPs to take a higher percentage of the ad spend as a fee. Header bidding, on the other hand, changed the dynamic to an auction environment. SSPs now all generally have access to the same or similar inventory – those operating within the same vertical that is – and DSPs partner with multiple SSPs to bid on the inventory made available through each. While this bidding structure has led to higher revenues for publishers, it has also led to much lower latency and higher costs for the DSPs who have to process an exceptionally large number of bid requests every second.

Supply Path Optimization

Enter supply path optimization (SPO). It did not take long after the advent of header bidding for DSPs to begin throwing this term around, but I believe it is just now starting to ramp up. In short, SPO is the process in which ad buyers and DSPs cut down on the number of SSPs they work with based upon the relative value each SSP adds to the process. In the not-so-distant future, the SSPs that will win more ad spend are those that don’t just connect the buyers and sellers. It’ll be those that truly offer products and services that add value to the supply chain. Magnite has a history of making strategic acquisitions and developing innovative products that set itself apart from the pack. One such example is Magnite’s acquisition of nToggle in 2017. The nToggle technology is able to reduce DSP infrastructure costs by compressing bid requests by up to 80% – a significant resource for DSPs and one that will help ad spend continue to flow through Magnite.

Even though publishers are now getting greater value for their inventory, they are also noticing the problems with the current supply chain. Just a few months ago the Incorporated Society of British Advertisers and PricewaterhouseCoopers released a report that illuminated the fact that publishers only receive 51% of the money actually spent on programmatic ads. Not only that, but 15% of that ad spend is lost somewhere in the supply chain. In other words, after taking into account the fees received by the demand- and supply-sides, 15% of the total spend is still unaccounted for. The highly fragmented nature of the supply chain is a significant reason it is so difficult to decipher where the money actually goes. By working with fewer SSPs, it is far easier for buyers to track and understand what fees are being charged and at which part of the supply chain. As such, more and more buyers are reviewing their supply-side partnerships and weeding out those that don’t seem to offer added value.

In November 2019, PubMatic released a report on the state of supply path optimization. In it, the company referenced a survey they conducted stating that 45% of buyers were already implementing SPO, and 28% were planning to begin implementing within 12 months. That is to say, nearly 75% of buyers will be actively implementing SPO strategies by the end of this year. I imagine that number will be even higher as smaller SSPs are already being pressured due to advertising pullback and a greater focus on cost efficiencies across the entire supply chain.

Some buyers will make SPO considerations based on what specific channels best fit their advertising campaigns (i.e. display vs mobile vs video, etc.). However, I’d argue the majority of buyers, at least the largest ones, will decide based on which platform gives them access to the best inventory across as many channels as possible. As I further describe in this article, Magnite is one of only two SSPs in the industry that is omnichannel. That is, Magnite is a top SSP in Display, Mobile, Video, and Out-Of-Home advertising.

The benefit of being one of the only omnichannel platforms is already starting to bear fruit for Magnite. In 2019 Havas – a top advertising agency – reduced the number of SSPs it worked with from 42 to 7. One of those seven is Magnite. Additionally, MediaMath – a top DSP – partnered with Magnite to begin reimagining the programmatic supply chain (i.e., supply path optimization). This is further evidence that Magnite will remain a top SSP partner among the buy-side and should be viewed as such among investors.

All of this is to say that if you’re asking the question “Will supply path optimization help Magnite?” then you’re asking the wrong question. The right question is: “How much additional ad spend will flow to Magnite as a result of supply path optimization?”

Global Programmatic Advertising Spend

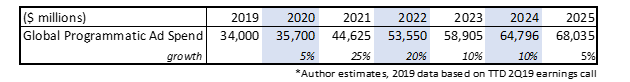

To answer this question, we first have to look at where the global programmatic advertising market is right now and where it’s going. On Trade Desk’s (TTD) 2Q19 earnings call, CEO Jeff Green noted that global programmatic ad spend was estimated to be around $34 billion. There are a few other estimates out there that are significantly higher (e.g., Zenith estimated it at $106 billion in 2019). I suspect the $34 billion number does not include search and social, which is a better proxy for Magnite’s addressable market, hence I base my assumptions around that.

eMarketer estimated in July 2020 that US programmatic display ad spend will grow at 6.2% in 2020, despite the havoc the pandemic has wreaked on the economy. With that said, I take the conservative outlook that global programmatic ad spend will grow at 5% in 2020 and rebound at a 25% growth rate in 2021.

These estimates represent a ~14% CAGR from 2020 through 2025, which I view as conservative given the ~30% CAGR that the industry saw from 2014 to 2019.

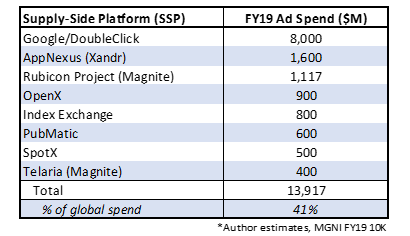

Using these numbers for global ad spend, I attempted to back into market share numbers for the supply-side to see where Magnite stacks up against other platforms. This isn’t as straightforward as it may be for other industries, owing to the fact that a large number of industry players are private companies and the general lack of transparency in the industry. I wasn’t able to find a definitive list of the top supply-side platforms out there, but given a couple different reputable sources I pulled together what I think are the top seven platforms.

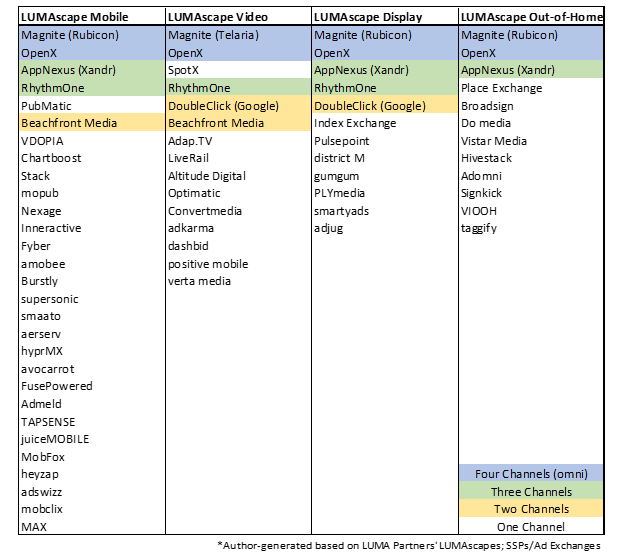

If you haven’t taken a look at LUMA Partners’ LUMAscapes, I highly recommend it if you want to get a clear picture of the industry landscape. Using these, I broke out all the SSPs and ad exchanges for each vertical (display, mobile, video, and out-of-home) – see below.

There are a few important things to take away from this list.

Magnite and OpenX are the only two players that operate in all four categories (i.e. they are omnichannel). As I mentioned before, this is becoming increasingly valuable for large DSPs and advertisers as they continue to scale back on the number of SSPs they work with. Many are moving more of their ad spend towards platforms that offer true value and can give them the most access to quality ad inventory across multiple channels (as seen with the partnerships between MediaMath, Havas and Magnite in 2019). Additionally, as a few others have already written about here on Seeking Alpha, access to CTV is extremely valuable given its expected growth. Rubicon Project didn’t have a presence in that vertical before the Telaria (TLRA) merger and subsequent rebranding to Magnite. This further helps to solidify Magnite’s value proposition to buyers and its stable position in the industry.

AppNexus (Xandr) and RhythmOne operate in three categories, while Beachfront Media and DoubleClick (Google Ad Manager) operate in two. However, it’s safe to say Google (GOOGL) dominates those two categories. Lastly, there are 50 supply-side companies noted here that only touch one vertical. This is exactly what supply path optimization is targeting; most of these “monochannel” players don’t actually add value to the supply chain – they are just duplicative in terms of the services and ad inventory they provide.

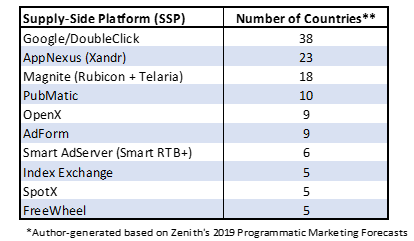

Zenith also put out a Programmatic Marketing Forecast in 2019, which highlighted what it saw as the top sell-side programmatic vendors among 48 countries. These 48 countries represent more than 90% of total global programmatic ad spend. I took a look through that as well to see if I could confirm who the top players seem to be in the industry. Here are the SSPs that appeared most frequently among the top five sell-side vendors in each country:

**To be sure, these numbers show in how many countries, out of 48, each platform is among the top 5 SSPs in terms of programmatic ad spend serviced within that country.

This tells me that Magnite is anything but a small player on the supply-side of the industry, despite what its current market cap insinuates. Using these two sources, I took the names that appeared on both lists and estimated each platform’s share of the total global programmatic ad spend.

Feel free to skip the rest of this section if you don’t care about how I reached my estimates for ad spend.

Rubicon Project:

Ad spend is the actual number, as noted in Magnite’s FY19 10K.

AppNexus:

Acquired in August 2018 by AT&T (T) and rolled up into its Xandr business segment. When the acquisition was first announced, it was speculated that the purchase price was going to be ~$1.6B. In my view, SSPs will typically trade between 0-1x EV / next fiscal year ad spend (see valuation section below for reasoning), and DSPs between 1-2x EV / next fiscal year ad spend (due to the fact DSPs are able to maintain higher take rates, or fees as a percentage of ad spend serviced). Because AppNexus operates as both a DSP and SSP, I assume that the $1.6B price was based on 1.0x EV to FY19 ad spend. By the time the acquisition closed, AT&T only ended up paying $1.4B (T FY19 10K). My thoughts are that with General Data Protection Regulation (GDPR) going into effect around the same time and other data privacy concerns heating up around programmatic advertising, AT&T was able to fetch a slight discount to that original multiple.

Google/DoubleClick

This is not Google’s main advertising business – it is a relatively minor part of the overall business (laughable, I know). That being said, I found some metrics put out by Datanyze that pegged Google’s ad exchange business at about 5x the size of AppNexus’. That’s where the $8B number comes from.

OpenX

Despite the fact that OpenX is a top SSP in only half as many countries as Magnite, it is still the only other omnichannel platform. So I assume (I’ll admit somewhat blindly) that its ad spend is about 20% less than Magnite at ~$900M.

Telaria

Telaria never shared specific take rates before the merger, but on its 1Q19 earnings call CEO Mark Zagorski noted they have generally always been in the 15-20% range. Taking FY19 revenue of $68M, ad spend could then have been between $340M (20% take rate) and $453M (15% take rate).

SpotX

Similar to Telaria, SpotX operates as a video-first platform. Based on Zenith’s programmatic forecast mentioned earlier, it seems SpotX may have a larger presence – I estimate a slightly higher $500M in ad spend.

Index Exchange & PubMatic

I believe Telaria and SpotX represent the lower bounds for this group in terms of ad spend serviced, being that video is still the smallest channel of programmatic ad spend. With that being said, I believe ad spend for Index and PubMatic is somewhere between that of SpotX and OpenX. Both Index and PubMatic operate in only one channel, display and mobile, respectively. Being that display is still the larger market relative to mobile in terms of total ad spend, I estimate Index at $800M and PubMatic at $600M.

I understand these last two may seem somewhat arbitrary, but I’m confident that the range I have between the maximum and minimum for these top platforms puts us in a good position to make accurate estimates. One of the unfortunate aspects about this industry is the lack of transparency around these numbers, but I think it’s important to start somewhere.

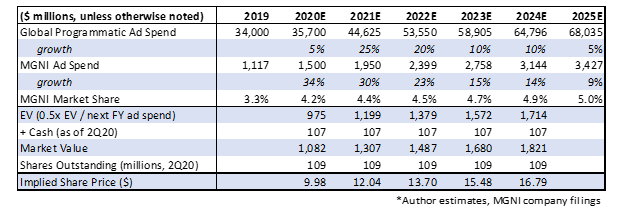

Given these estimates, we can see that Magnite stands safely among the top five supply-side platforms. It’s important to understand that this is not a winner-take-all environment; the top seven supply-side platforms account for just over 40% of global programmatic ad spend. It’s safe to say the top ten platforms service roughly 45% of overall ad spend. In other words, 55% of global ad spend is either serviced by the other 50+ supply-side platforms or lost somewhere in the complex programmatic supply chain (the 15% “unknown delta” mentioned earlier). As supply path optimization continues to gather momentum and DSPs consolidate the number of SSPs they work with, I believe that more and more ad spend will flow towards the top ten platforms in the industry. I estimate that by 2024 ~60% of global programmatic ad spend will be serviced by the top ten SSPs. As Magnite is safely positioned among that group, and has the products, services and relationships to remain there, I estimate Magnite will easily capture a portion of that extra spend. This will allow the company grow faster than the industry and increase its market share from 3.3% in 2019 to roughly 5% in 2024. This could push its share price up to nearly $17 (~120% increase from closing price of $7.62 on 8/24/2020, or a ~22% CAGR through 2024).

Note, the 34% growth in 2020 is a result of the Rubicon/Telaria merger.

Valuation & Risks

As you can see, I prefer to use the valuation metric of enterprise value to advertising spend. I believe it’s an easy metric to work with and it gives you a multiple on the business before taking into account a specific take rate. You can then use this metric to back into implied EV / sales multiples based on expected take rates – I won’t go through the arithmetic but you simply divide EV / ad spend by the expected take rate to get to the implied EV / sales multiple. For example, I modeled a 12% take rate in 2025, so the 0.5x EV / FY25 ad spend implies a 4.2x EV / FY25 sales multiple (0.5 / 12%). Again, this just comes down to preference, I prefer to look at historical and future valuations prior to taking into account company-specific take rates.

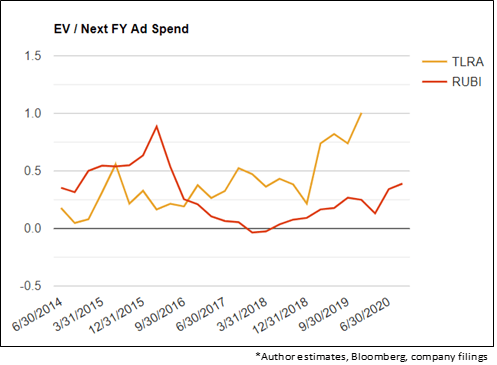

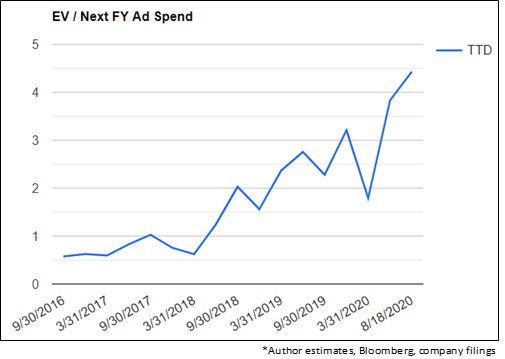

Below I show the historical valuations for Telaria, Rubicon Project, and The Trade Desk, which I used to get a sense of valuation ranges for SSPs and DSPs.

To be crystal clear, Rubicon Project and Telaria merged earlier this year to form the largest independent, omnichannel SSP – Magnite. Beginning April 1, 2020 the red line in the first figure represents the combined company’s valuation. This is where I get my SSP valuation range between 0-1x EV / next FY ad spend.

The Trade Desk is a prominent DSP. As I mentioned above when talking about the AppNexus acquisition, I believe a fair multiple to apply to DSPs is between 1-2x EV / next FY ad spend because of the higher take rates they receive relative to SSPs. That represents the general range Trade Desk traded within during the first ~4 years it was public. Perhaps it’s warranted that Trade Desk can command a slightly higher multiple than that now based on its spectacular performance over the past few years and position on the demand-side of the industry.

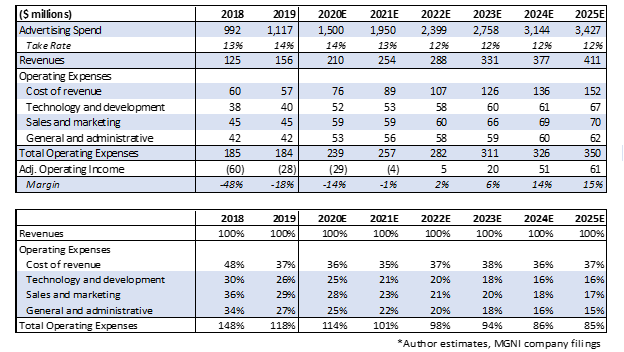

Below I modeled out projected revenues and operating profit for Magnite. As you can see, I do include continued pressure on take rates, which is certainly a risk to Magnite and all supply-side platforms moving forward and should be monitored. However, Magnite’s strategy is to be a high volume, low cost platform. As SPO causes the company to capture more market share, it will be able to grow its margin profile due to the platform’s operating leverage (high fixed costs causes strong top line growth to lead to even stronger bottom line growth). This will allow Magnite to continue executing on its strategy and will more than offset any potential further decline in take rate, leading to what I expect will be a stable valuation at or above 0.5x EV / next FY ad spend. Note, I believe Magnite can maintain its annual take rate at or above 12% over the next five years.

The last thing I want to touch on here is this: If you’re unfamiliar with Rubicon Project’s history and curious why its enterprise value fell so substantially from 2016 to 2018, it’s because the company missed the transition to header bidding. It was one of those top SSPs in the pre-header bidding era that held exclusive and/or preferential relationships among publishers. However, it did not react quickly enough to the dramatic change taking place in the industry and saw its ad spend and take rate erode. The company (again, now Magnite) has done a tremendous job at rebounding since then, bringing on an entirely new management team with significant advertising experience that has led Magnite back to a leading position on the supply-side of the programmatic industry.

Conclusion

Programmatic advertising is still a relatively minor percentage of overall global advertising spend, but its share is growing rapidly. Trade Desk has been the beneficiary this year of investors seeking to get exposure to this high growth market. However, investors are overlooking the structural changes in the industry that supply path optimization is causing. SPO is beginning to shine a spotlight on the higher value proposition of the top supply-side platforms relative to smaller, duplicative platforms. As a result, a higher percentage of global ad spend will flow to the top ten players in the industry over the next five years.

Investors seeking exposure to the economic benefits that will result from SPO should develop a long position in Magnite, as it is currently the only pure play public company operating on the supply-side of programmatic advertising. It is also one of only two SSPs that are omnichannel. That is, it operates and provides access to ad inventory across all programmatic channels, most importantly the burgeoning vertical of CTV. This is an increasingly valuable trait to have as programmatic buyers move forward with consolidating the number of SSPs they work with in order to create a more efficient supply chain.

Magnite is one of the top three SSPs in terms of global ad spend serviced, with a 3.3% share of global programmatic advertising spend in 2019 (this excludes search and social – i.e., Facebook, Google Search, etc.). I believe Magnite will maintain its position as a top supply-side platform and grow its market share from 3.3% in 2019 to ~5% in 2024. At a 0.5x EV / FY25 ad spend, that will lead to a share price of nearly $17 in 2024, or roughly a 22% CAGR from its closing price of $7.62 on 8/24/2020.

Disclosure: I am/we are long MGNI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.